carried interest tax concession

Travelling expenses of directors and employees earning 8500 a year or more A5. 200000 as the case may be.

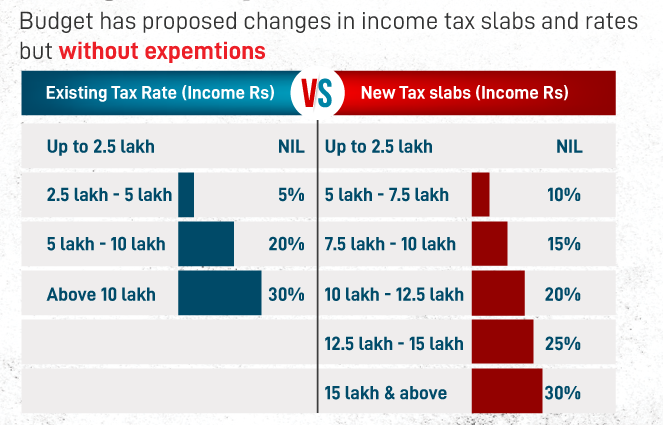

How Much You Gain By Reduced Tax Slabs In Budget 2020

Deduction for interest on borrowed capital is allowed up to Rs.

. A new scheme of taxation has been introduced by the Finance Act 2020 by insertion of a new Section 115BAC. Creditor repos and creditor quasi-repos. Where to go next.

Expenses allowances and benefits in kind A6. Manufactured interest treated as interest under loan relationship. Ignoring effect on lender.

Written on your tax return the total of your other income. Meaning of creditor quasi-repo. House property could not be occupied by the owner due to employment or business carried on at any other place.

Go to Total supplement income or loss 2021. CONCESSIONS APPLICABLE TO INDIVIDUALS INCOME TAX AND INTEREST ON TAX A1. Flat rate allowances for cost of tools and special clothing A2.

This will be done alongside a broadening of the corporate income tax base by limiting interest deductions and assessed losses. Deduction for interest on borrowed capital is allowed up to Rs. Meaning of creditor repo.

NEW TAX PROPOSALS FOR 2021. Debits for deemed interest under stock lending arrangements disallowed. 200000 as the case may.

The corporate income tax rate will be lowered to 27 for companies with years of assessment commencing on or after 1 April 2022. The basic feature of this new tax regime is lower tax rates as compared to existing slab rates but on the other hand the assessee has to forego around 70 exemptions and deductions presently available. Pensions to police officers and firemen A4.

Attached to page 3 of your tax return your Schedule of additional information Item 24 if you need to send us one.

Apple Pages Business Plan Template Luxury Business Plan Template Apple Iwork Pages And Numbers Business Plan Template How To Plan Business Plan Presentation

Section 115baa And 115bab New Tax Rate For Companies

Pwc Cn Publication More Good News Carried Interest Tax Concession

Asset Management Tax Update Kpmg China

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

New Tax Regime Complete List Of Exemptions And Deductions Disallowed Basunivesh

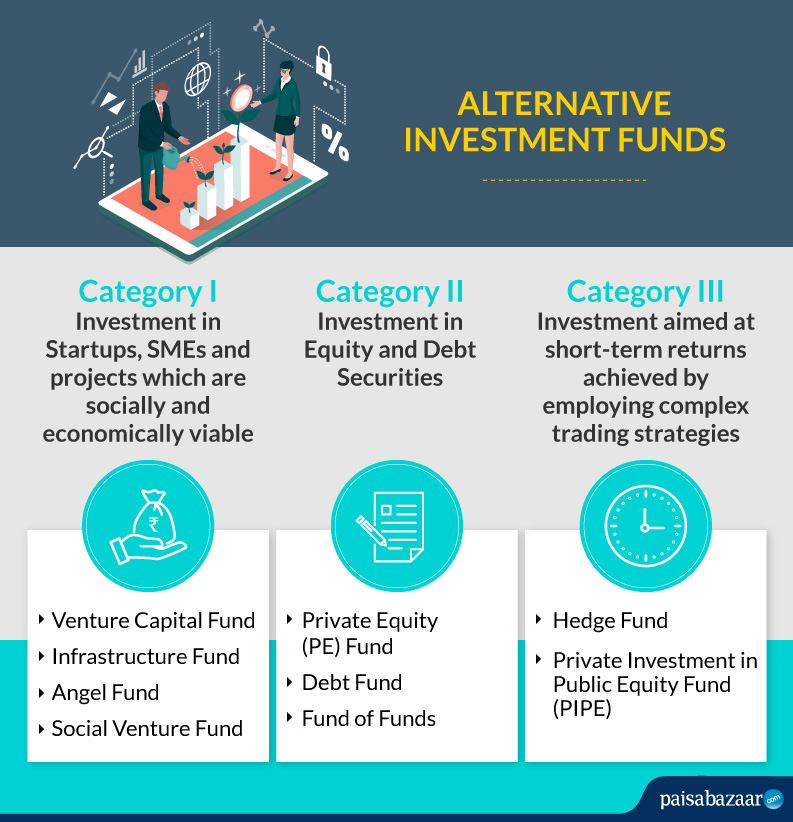

Alternative Investment Fund Know Types Taxation Rules List Of Best Aif

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Iasbaba S Mind Map Gaar Changes In Tax Treaties Issue 25th January Mind Map Mindfulness Map

Carry Forward And Set Off Of Losses In Tabular Form With Faqs

A New Era For Carried Interest In Hong Kong Kpmg China

Tax Treatment Of Income Under The Head Income From House Property

Asset Management Update Kpmg China

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Iasbaba S Mind Map Gaar Changes In Tax Treaties Issue 25th January Mind Map Mindfulness Map

Income From House Properties Exemption Relief And Practice Questions

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds